As tax authorities across Europe accelerate digital transformation, mandatory eInvoicing is no longer on the horizon, it’s already a compliance reality. With major rollouts underway across Europe and in markets like the UAE, Singapore and Jordan, a question remains for businesses:

Are you ready?

To help answer that confidently, we’ve created a Business Readiness Checklist based on the latest regulatory developments and common pain points we see when supporting businesses like yours.

Business Readiness Checklist

- Regulatory readiness

- Do you operate in a country with an upcoming eInvoicing mandate?

- Are you aware of the compliance deadlines and formats for each country you operate in?

- System and data readiness

- Can your current system generate and transmit the required structured formats? e.g. Most mandates require structured formats like XML, UBL, rather than PDFs.

- Is your current system integrated with national platforms for real-time submission?

- Can it validate invoices and reconcile data automatically across systems?

- Do you have a plan for a real-time data integration? Mandates often require invoices to be transmitted immediately or within short timeframes to tax authorities.

- Team and process readiness

- Have you trained your Accounts Payable (AP)/ Accounts Receivable (AR) teams on new workflows?

- Have you mapped invoice flows from ERPs to the tax authority and back?

- Are your audit controls and documentation in place?

- Are you tracking ongoing regulatory changes via expert sources or technology partners?

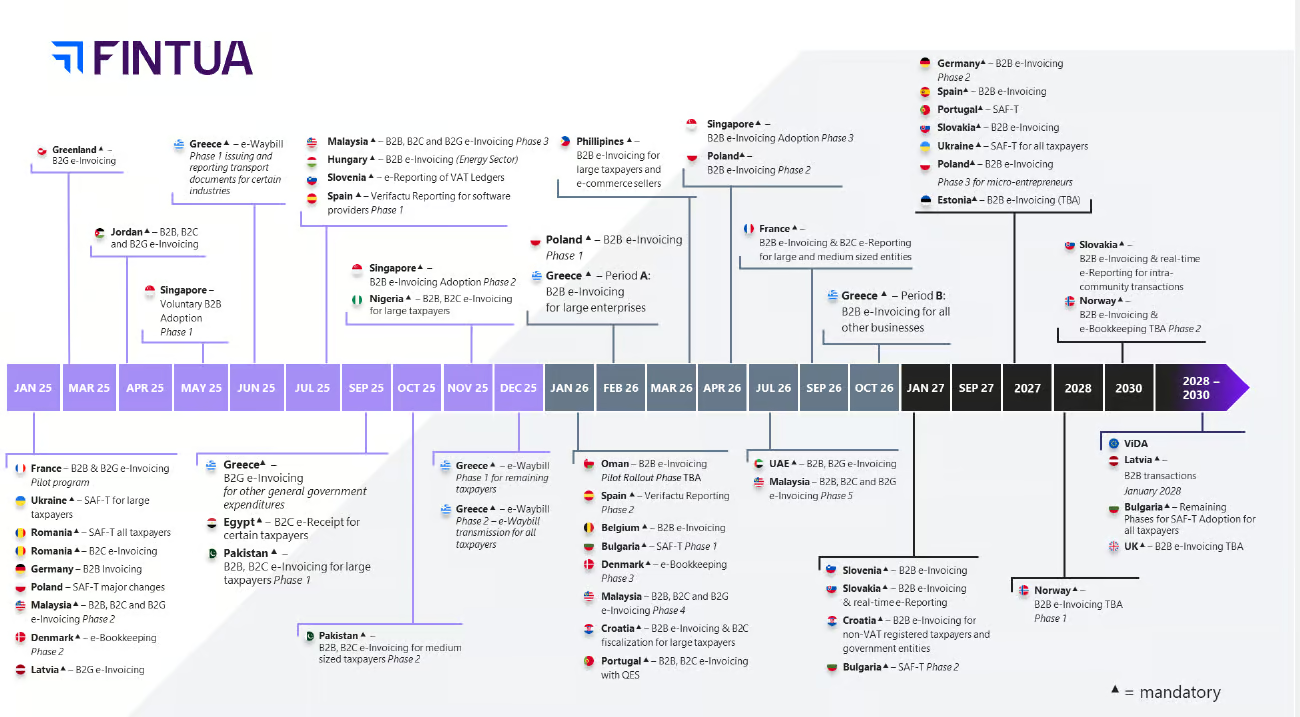

Upcoming eInvoicing mandates

How Fintua supports eInvoicing mandate readiness

RTC and Fintua provide end-to-end support to ensure businesses are not just compliant but ready to thrive under evolving eInvoicing mandates. From understanding local requirements to seamless integrations with existing systems, both companies help streamline eInvoicing processes and stay ahead of regulatory changes.

Together, RTC and Fintua offer:

- Comprehensive regulatory expertise: With in-depth knowledge of global eInvoicing laws, RTC and Fintua assist businesses in navigating each country’s specific compliance requirements, from format specifications to reporting deadlines.

- Real-time data integration: RTC and Fintua’s solutions ensure smooth, real-time integration with national platforms, enabling automatic invoice submission and validation without disrupting existing operations.

- Global connectivity: Whether operating in Europe, the UAE, Singapore, or beyond, RTC and Fintua’s solutions are designed to support multiple markets with a single, scalable platform that grows with businesses.

- Audit-ready reporting: Both RTC and Fintua ensure that eInvoicing data is always audit-ready, with robust tracking, documentation, and reporting capabilities for easy access during tax audits.

- Agility and scalability: As eInvoicing mandates continue to evolve, RTC and Fintua enable businesses to stay flexible, adapting quickly to new requirements and ensuring ongoing compliance.

With RTC and Fintua as partners, businesses not only meet the compliance requirements of today but also position themselves for the challenges of tomorrow.

A modern eInvoicing partner helps you:

- Reduce compliance risk

- Simplify global eInvoicing operations

- Have faster response to mandate changes

- Have peace of mind during audits

Future-proof your eInvoicing

“Staying compliant today is essential – but building agility into your eInvoicing processes is what sets future-ready businesses apart” – Ridvan Yigit, CEO RTC.

Ready to check your readiness for eInvoicing?

Fintua helps global businesses simplify eInvoicing compliance — from real-time validation to ERP integration and audit readiness.

Get in touch to assess your readiness or learn how we can help you stay ahead of evolving mandates.