eInvoicing

Whitepapers

The business case for eInvoicing

Cost savings, cash flow and compliance benefits for global businesses

Discover the business case for eInvoicing, including cost savings, faster cash flow, reduced compliance risk and future-ready tax automation for global businesses….

VAT News Updates

International VAT Rate Round Up: January 2026

The January edition of our International VAT Rate Round Up highlights the latest VAT rate updates from around the world….

VAT News Updates

International VAT Rate Round Up: February 2026

The February edition of our International VAT Rate Round Up highlights the latest VAT rate updates from around the world….

VAT News Updates

Global VAT Guide: January 2026

Explore the January 2026 Global VAT Guide with key updates from jurisdictions across the globe. Stay compliant globally….

VAT News Updates

Global VAT Guide: February 2026

Explore the February 2026 Global VAT Guide with key updates from jurisdictions across the globe. Stay compliant globally….

VAT News Updates

Mauritius introduces VAT on Non-Resident Digital Services from 2026

From 1 January 2026, Mauritius will impose VAT on digital and electronic services supplied by non-resident providers. The Mauritius Revenue Authority has issued guidance to help fo…

VAT News Updates

What’s changing in the Germany 2026 preliminary VAT return?

Germany has updated its VAT return form for 2026, introducing new transitional warehousing rules, revised flat-rate calculations for agriculture and a new reporting line for EU SAF…

VAT News Updates

Intrastat Thresholds for 2026

EU Intrastat thresholds for 2026 have changed, affecting when businesses must report goods movements and whether simplified or detailed declarations apply….

VAT News Updates

Belgium eInvoicing penalty tolerance period

Belgium is moving toward mandatory eInvoicing, with new guidance on enforcement and implementation ahead of 2026, including a temporary penalty tolerance period and key technical a…

On-Demand Demos

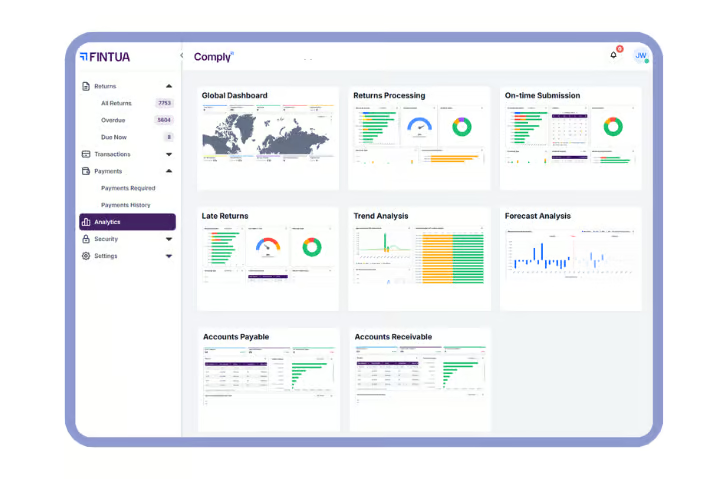

Comply – VAT Compliance Solution

Empower your finance team for the future of VAT. Discover how Comply..

Read more

VAT News Updates

International VAT Rate Round Up: January 2026

The January edition of our International VAT Rate Round Up highlights the..

Read more

VAT News Updates

Global VAT Guide: January 2026

Explore the January 2026 Global VAT Guide with key updates from jurisdictions..

Read more

VAT News Updates

Mauritius introduces VAT on Non-Resident Digital Services from 2026

From 1 January 2026, Mauritius will impose VAT on digital and electronic..

Read more

VAT News Updates

Belgium eInvoicing penalty tolerance period

Belgium is moving toward mandatory eInvoicing, with new guidance on enforcement and..

Read more

Education

VAT recovery in the motorsport industry

Motorsport organisations operate across multiple jurisdictions, incurring significant foreign VAT on travel,..

Read more

Education

VAT recovery in 2026: Discover how much you could reclaim

Millions in recoverable VAT is written off every year, not because businesses..

Read more

VAT News Updates

European Union eInvoicing EN 16931 update

The EU is reshaping digital VAT around EN 16931, and businesses that..

Read more

Pall Corporation