Streamline and automate VAT recovery process – across travel, accounts payable and more. Unlock maximum reclaim value with intelligent automation and seamless integration, designed to simplify every step of your VAT recovery journey.

What is

?

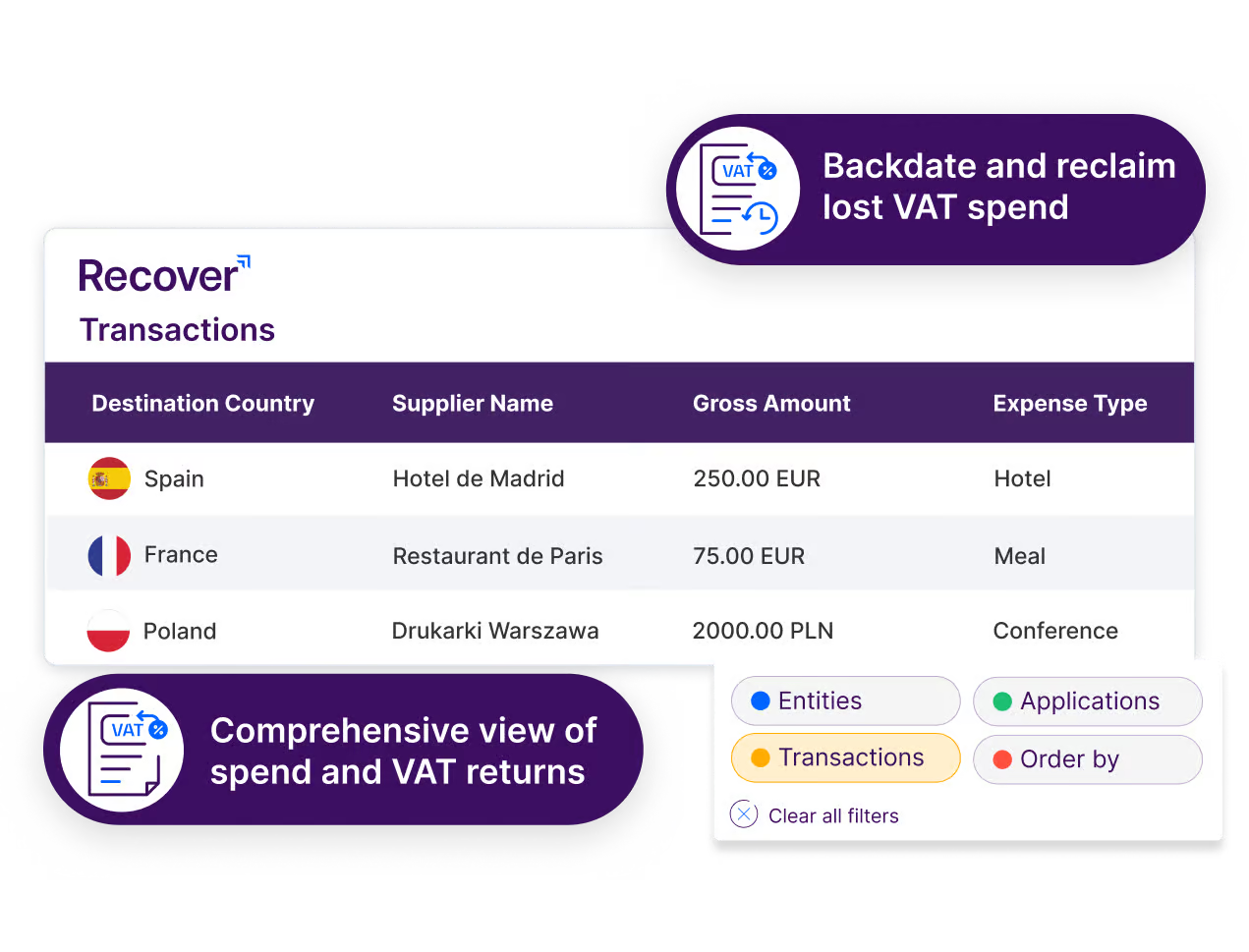

Recover is our secure, intelligent solution for reclaiming both domestic and foreign VAT effortlessly and accurately.

By integrating your Expense Management System, Recover identifies every transaction with VAT reclaim potential and streamlines it into a compliant, automated process. It eliminates errors, ensures regulatory alignments and unlocks maximum reclaim value – so your business can boost its bottom line without the manual burden.

Eliminate manual processes

Maximise your reclaim. Minimise your risk.

Recover automates VAT identification and submission, eliminating time-consuming manual tasks. Streamline your reclaim process and reduce the risk of costly errors.

Automated intelligence delivers expert analysis

Recover uses advanced AI and machine learning to review and validate every transaction. It automatically applies country-specific VAT rules, ensuring accuracy, compliance and maximum reclaim value.

Seamless integrations capture every transaction

Automatically capture data and images from expense systems, ERPs, corporate cards, hotel groups and travel management companies (TMCs) – giving you a complete, real-time view of your total spend and reclaim potential.

Why Fintua

Fintua are reimagining what financial technology can achieve to help businesses thrive in a digital-first economy.

Risk mitigation

Avoid multi-million penalties due to non-compliance with indirect-tax regulations.

ROI

VAT reclaim funds VAT compliance for many of our customers, reducing long-term technology costs.

One global supplier

VAT compliance, eInvoicing, VAT reclaim and global payments through a singular, self-contained platform.

Efficiency

Automate processes, reduce manual effort and allocate resources more effectively.

Cutting-edge security

Your data. Protected at every level.

At Fintua, security is never an afterthought – its foundational. All data in transit is encrypted using SSL certificates (TLS 1.2), safeguarding your confidential information from unauthorised access. We partner with trusted providers like Interxion and AWS to ensure enterprise-grade protection and compliance across every jurisdiction.

The OLD way

Traditional

VAT recovery

The New way

VAT recovery

with Fintua

| Data Collection | Manual collection of receipts and invoices from various sources | Seamless integration and automatic data capture from all relevant systems |

| Error Checking | Manual validation and high risk of missing eligible VAT | Automated eligibility checks and error detection |

| Submission Process | Complex, paper-based, and country-specific; often delayed | Hassle-free, automated submission with built-in compliance |

| Visibility & Tracking | Limited insight into claim status and recovery progress | Full visibility through a real-time dashboard with claim tracking and analytics |

| Compliance Monitoring | Occasional updates and risk of missed deadlines or rule changes | Automatic updates and real-time compliance monitoring |

| Reporting & Analysis | Manual report preparation; slow response to audits | Instant, detailed reporting and audit-ready documentation |

| Team Involvement | Heavy team workload for gathering, checking, and submitting claims | Minimal involvement; the Fintua platform manages the end-to-end process |

| Scalability | Difficult to manage across multiple countries and entities | Scales effortlessly with your business, no matter the size or location |

| Efficiency | Slow, error-prone, and often results in missed VAT recovery | Fast, accurate, and maximises your VAT reclaim with minimal effort |

| ROI & Cost Coverage | VAT recovery rarely offsets the cost of compliance solutions; savings often unrealised | Optimised VAT recovery helps clients cover or offset the costs of their einvoicing and VAT compliance solutions, delivering immediate and long-term savings |

With Recover, clients not only maximise their VAT reclaim but can use these increased savings to cover the costs of their eInvoicing and VAT compliance solutions-turning compliance into a value driver for the business.

Expand your knowledge

with the Fintua Knowledge Hub

Trusted by businesses worldwide, the Fintua Knowledge Hub is your number-one source for Indirect Tax education and inspiration.

Customer stories

12,000+ customers control

their indirect taxes with Fintua

Frequently Asked Questions

-

What type of VAT can Recover help reclaim?

Recover supports the reclaim of both domestic and foreign VAT. Whether it’s VAT on travel expenses, accounts payable or supplier invoices, Recover identifies eligible transactions and processes them through a fully compliant and automated workflow. Maximising your reclaim potential with minimal manual input.

-

How does Recover integrate with our existing systems?

Recover seamlessly integrates with major Expense Management Systems (EMS) and ERP platforms. This connection can extract relevant transactional data securely, analyse it for reclaim opportunities, and feed it into an automated process—reducing workload while ensuring accuracy and compliance.

-

Is Recover compliant with local and international tax regulations?

Yes. Recover is built to stay aligned with local and international VAT laws. Its intelligent automation ensures each step of the reclaim process is compliant, helping your business stay audit-ready and avoid penalties—no matter the jurisdiction.

Rise Above the Rest

Maximise your potential with our full suite

VAT compliance solution

Comply streamlines the preparation and filing of VAT returns, ensuring adherence to local tax regulations while reducing manual workload and minimising errors.

Payments solution

Pay simplifies international payments, reducing complexity and costs while ensuring compliance with local regulations and improving financial visibility.

eInvoicing solution

eInvoice enhances efficiency by digitising your eInvoicing process, ensuring compliance across multiple jurisdictions and improving cash flow management.