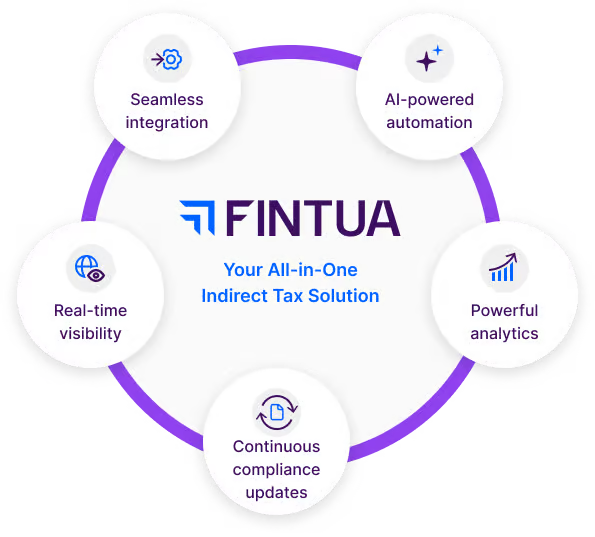

The Fintua Platform

Your all-in-one

indirect tax solution

Fintua empowers businesses to take control of complex indirect tax processes with intelligent automation, real-time insights and seamless integration. Adapt faster, stay compliant and simplify operations across every jurisdiction – all from one powerful platform.

What is the Fintua platform?

A unified platform for smarter indirect tax management.

Fintua brings VAT compliance, eInvoicing, VAT recovery and global payments together in one, powerful, intuitive platform. Built on decades of tax expertise and cutting-edge fintech, it simplifies even the most complex indirect tax challenges, so your team can focus on what matters most.

Experience the future of indirect tax management.

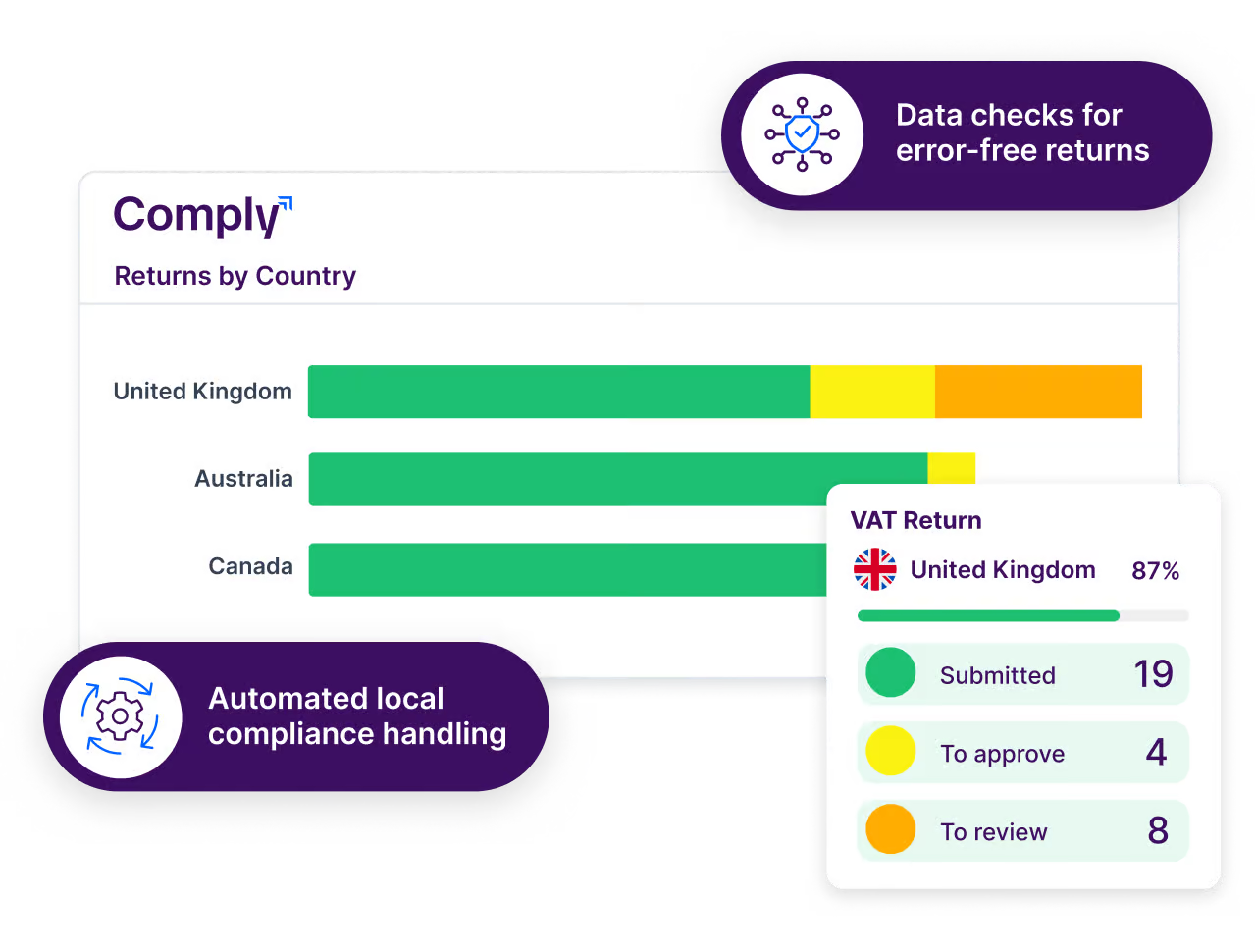

VAT compliance solution

Comply takes the complexity out of VAT compliance by automating the preparation and submission of returns. Built to align with local regulations across jurisdictions, it reduces manual effort, minimises risk and keeps your business audit-ready.

eInvoicing solution

With eInvoicing mandates and digital era tax reforms rolling out worldwide, legacy systems aren’t built to keep up. Simplify, standardise and scale your eInvoicing processes with Fintua – across every country you operate in. One powerful platform. Zero guesswork.

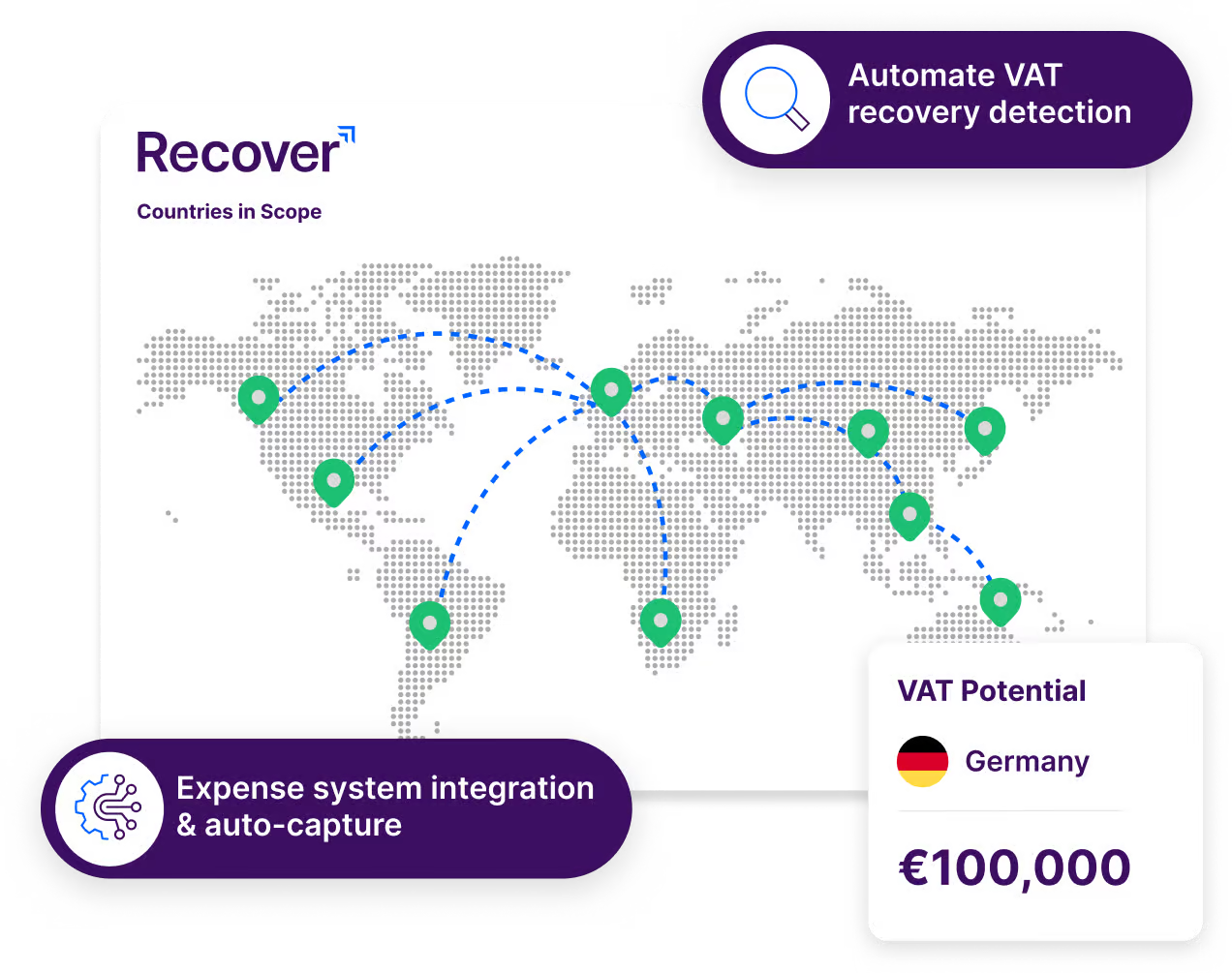

VAT recovery solution

Automate the process of identifying and reclaiming VAT on business expenses – domestic and international. Maximise returns, reduce manual effort and turn compliance into a growth opportunity.

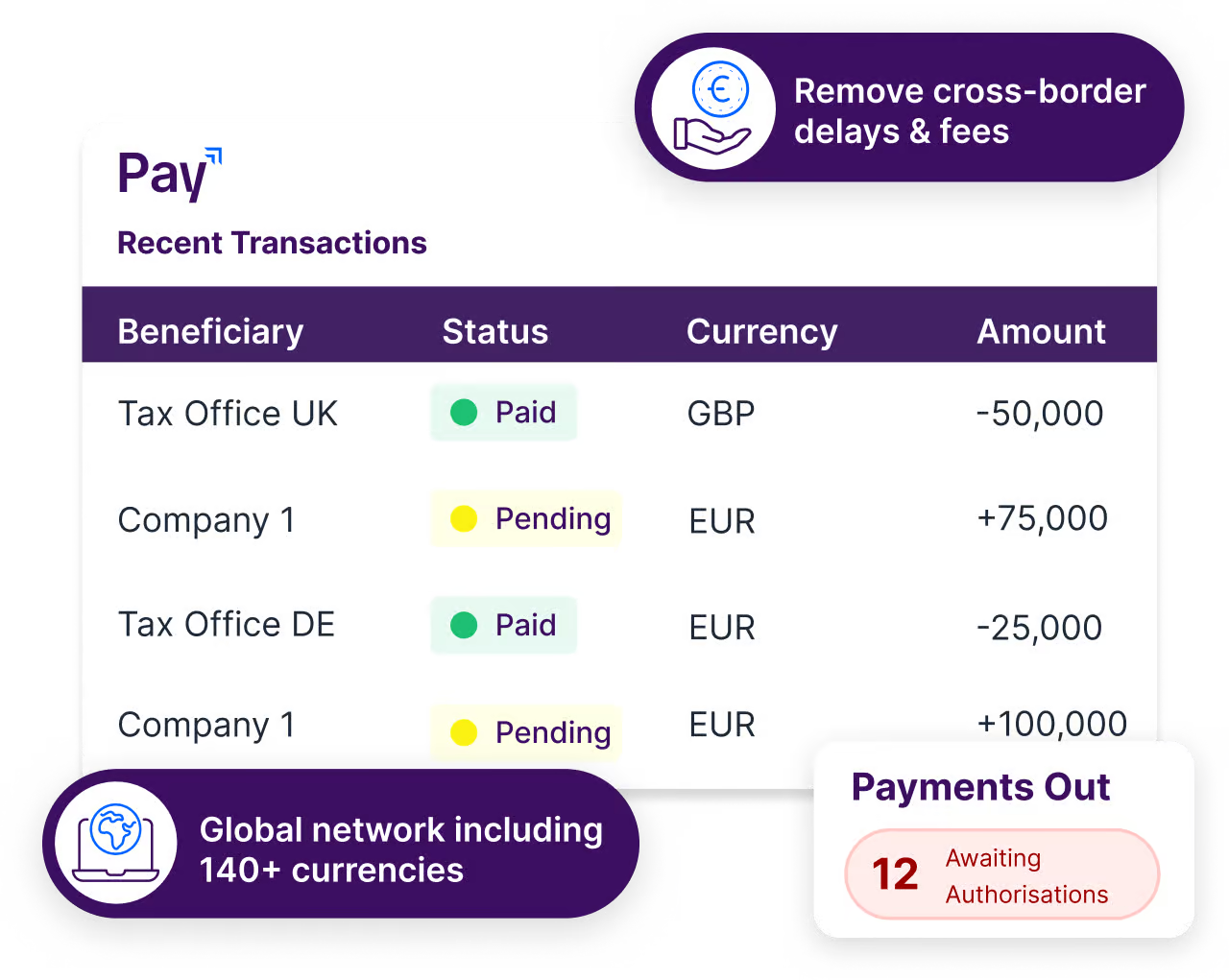

Global payment solution

Streamline cross-border payments by reducing complexity, cutting costs and ensuring full compliance with local regulations. Gain greater visibility and stay in control – wherever business takes you.

Fintua Benefits

Fintua is reimagining what financial technology can achieve – empowering businesses to thrive in a digital-first economy.

- Effortless integration

- Unmatched global expertise

- Smooth onboarding, seamless transition

- Your success is our priority

Effortless integration

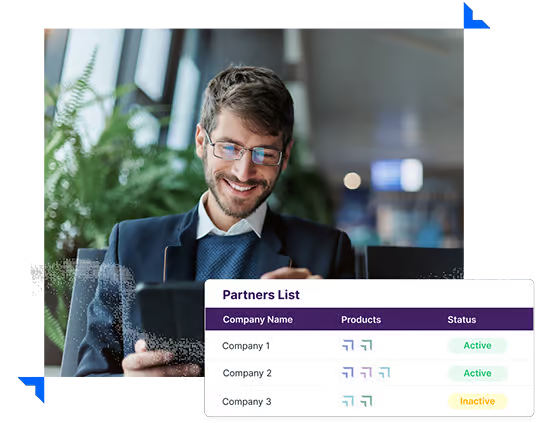

With Fintua, syncing sales and purchase data from your ERP has never been easier. Whether you use SAP, Oracle, Microsoft Dynamics or another ERP system, our robust integrations ensure real-time data flow. Giving you a complete accurate view of your indirect tax position and business operations.

Unmatched global expertise

We’re more than just a platform – we’re your partner in indirect tax. Our team of seasoned indirect tax professionals brings deep industry knowledge, global perspective and commitment to solving the challenges that matter most your business.

With Fintua, you’re backed by the insights and experience needed to stay compliant, agile and ahead of change.

Smooth onboarding,

seamless transition

We know that starting with a new platform can feel daunting, especially when you’re managing competing priorities. That’s why Fintua’s onboarding experience is built to be clear, efficient and fully supported. From day one, our team is with you every step of the way. Making your transition seamless and stress-free.

Your success is our priority

We don’t just solve problems, we solve them with you.

At Fintua, your challenges are ours. With our expert team by your side, you’ll have the guidance, insight and support needed to stay ahead of the curve and confidently navigate the world of indirect tax.

Cutting-edge security

Your data. Protected at every level.

At Fintua, security is never an afterthought – its foundational. All data in transit is encrypted using SSL certificates (TLS 1.2), safeguarding your confidential information from unauthorised access. We partner with trusted providers like Interxion and AWS to ensure enterprise-grade protection and compliance across every jurisdiction.

A solution for all businesses

- Distance sellers

- Enterprise

- Accountancy practices

- Digital sellers

- SMB

Distance sellers

Fintua helps eCommerce businesses rise above the complexities of cross-border trade. Whether you’re a startup entering new markets, a scaling business expanding globally or an established enterprise optimising operations – we’ve got you covered.

With Fintua as your partner, you can:

- Enter new markets with confidence

- Stay compliant with evolving global regulations

- Streamline VAT processes with intelligent automation

- Focus on growth, not administration

Enterprise

Fintua supports enterprise organisations in managing complex, multi-jurisdiction indirect tax environments with ease. Whether you’re operating across dozens of countries, integrating legacy systems or preparing for rapid expansion – our platform adapts to your scale and complexity.

With Fintua as your partner, you can:

- Gain real-time visibility into your global VAT position

- Ensure continuous compliance across all jurisdictions

- Integrate seamlessly with your existing ERP and finance systems

- Drive efficiency through intelligent automation and analytics

Accountancy practices

Fintua enables accountancy firms to transform their clients’ indirect tax strategies through our advanced solutions, including VAT compliance, eInvoicing, VAT recovery and global payments. With Fintua’s expertise and technology, you can streamline tax processes, reduce risk and shift focus to delivering high-value advisory services, while we manage the complexities of tax compliance.

With Fintua as your partner, you can:

- Simplify VAT compliance for clients cross jurisdictions

- Optimise VAT recovery and improve clients’ bottom line

- Reduce risk by staying ahead of regulatory changes

- Focus on strategic advisory

Digital sellers

Fintua helps digital sellers navigate the complexities of cross-border indirect tax with ease. Whether you offer digital products, software or services globally, Fintua’s solutions ensure you remain compliant as you expand your reach.

With Fintua as your partner, you can:

- Expand globally without fear of tax barriers

- Stay ahead of evolving regulations in multiple jurisdictions

- Automate compliance for digital products and services

SMBs

Fintua empowers small and medium businesses to confidently manage their indirect tax responsibilities. Our platform helps SMBs navigate the complexities of VAT compliance, eInvoicing and VAT recovery, all while keeping costs manageable and efficiency high.

With Fintua as your partner, you can:

- Simplify VAT compliance without the complexity

- Stay compliant as you grow and expand into new markets

- Automate processes to save time and reduce errors

- Focus on scaling your business

Customer stories

Over 12,000 global clients trust us

Mondelez international