Comply is Fintua’s all-in-one indirect tax solution, designed to help businesses overcome the complexity of multi-jurisdictional VAT. With smart automation, centralised control and integrated payments, Comply transforms compliance, reduces risk and gives you confidence to scale globally.

What is

?

Comply transforms the way global businesses manage indirect tax compliance.

Comply revolutionises indirect tax management for global businesses by automating the end-to-end VAT return preparation and submission across jurisdictions.

Seamlessly integrating with leading ERP systems, Comply drives efficiency, reduces risk, and scales with your business. Backed by Fintua’s expert support, it’s the smarter, faster way to stay ahead of ever-evolving tax requirements.

Intelligent automation

Take the manual work out of VAT compliance.

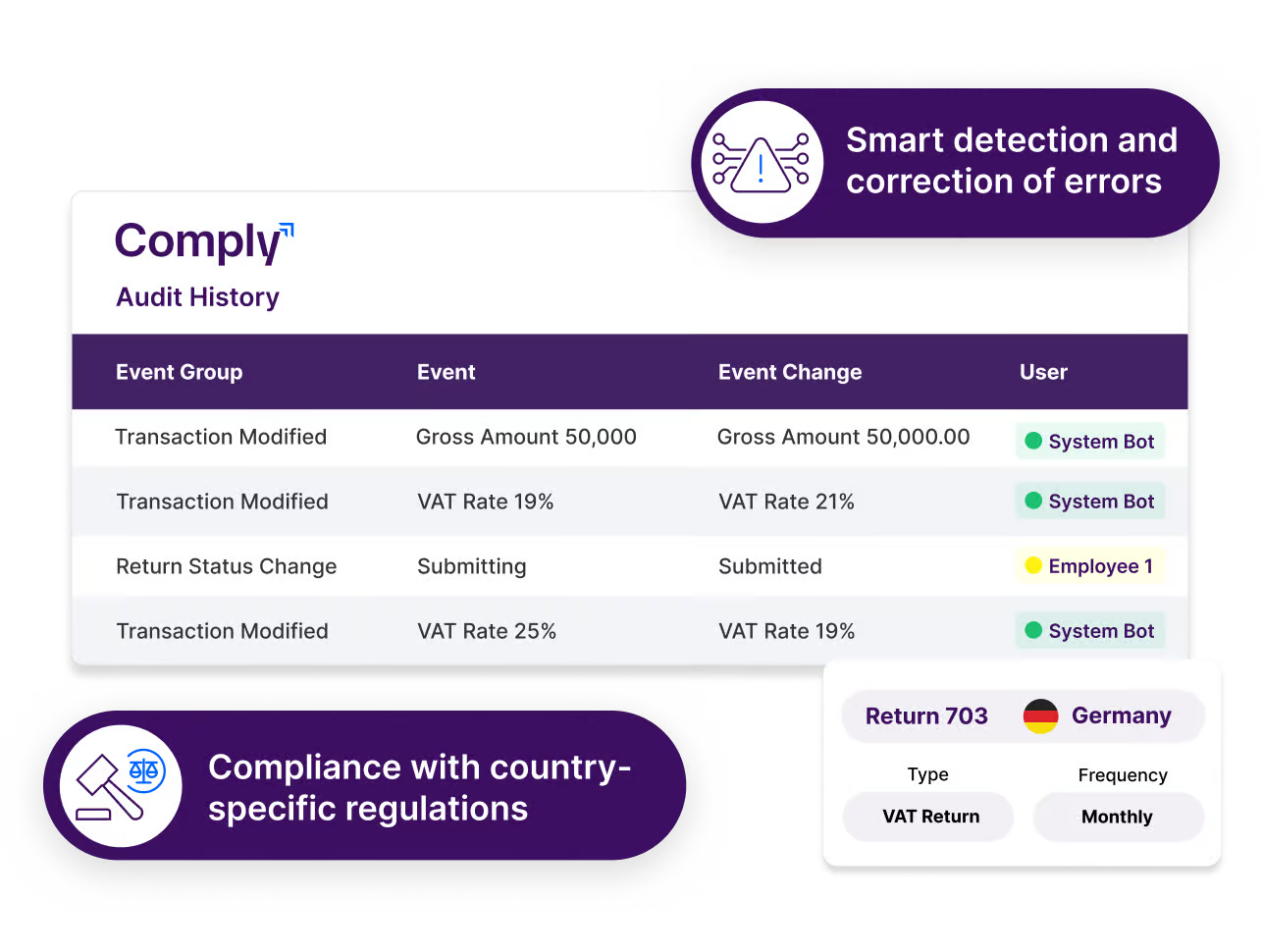

Comply automates the preparation and filing of VAT returns, handling complex calculations, data entry and reconciliation with precision. By eliminating manual processes complexities, it reduces errors, saves time and frees your team to focus on higher-value work.

Real-time monitoring

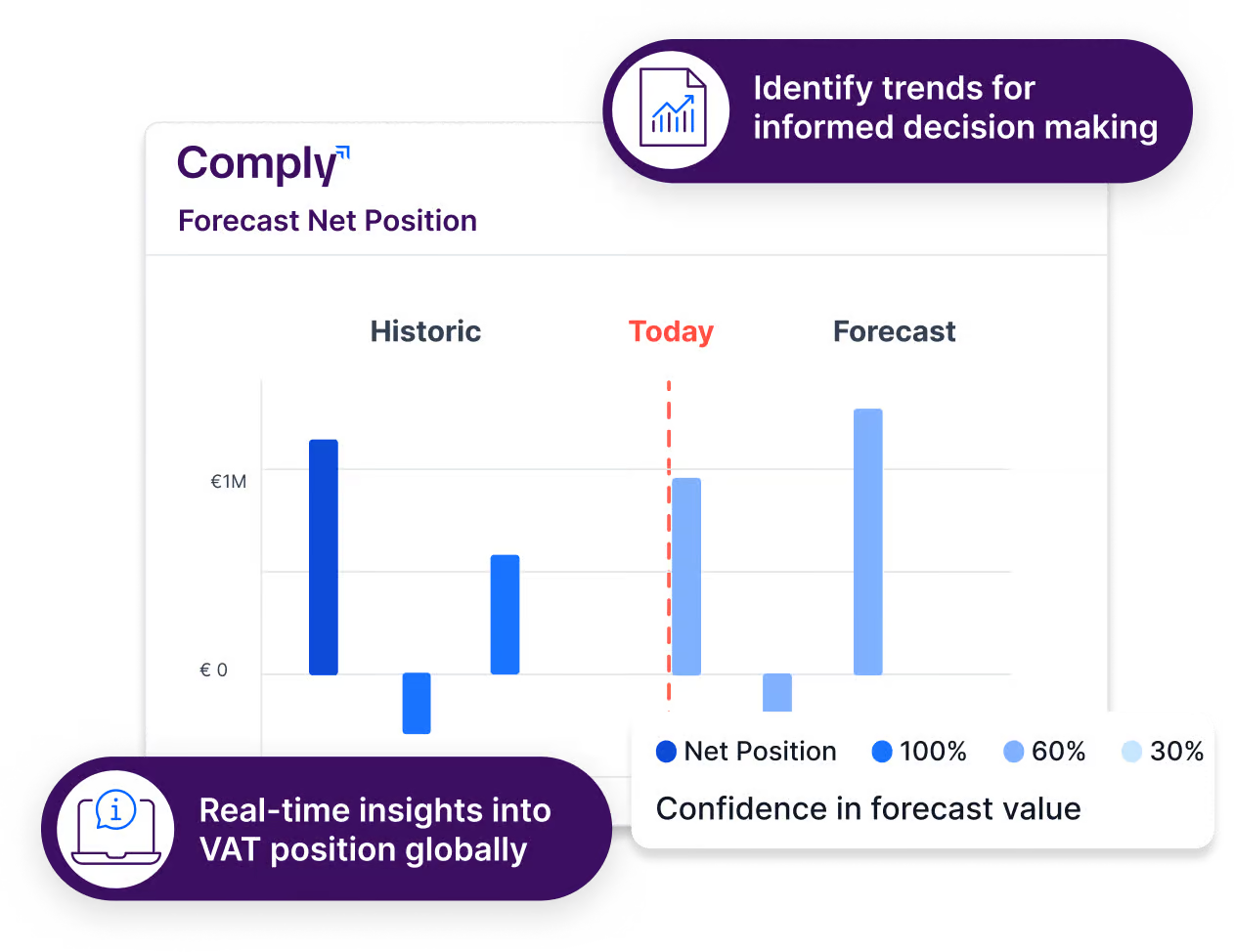

and analytics

Get instant visibility in your global VAT obligations and compliance status through intuitive, centralised dashboards. With powerful analytics and trend insights, you can forecast with confidence, make faster decisions and strengthen financial control.

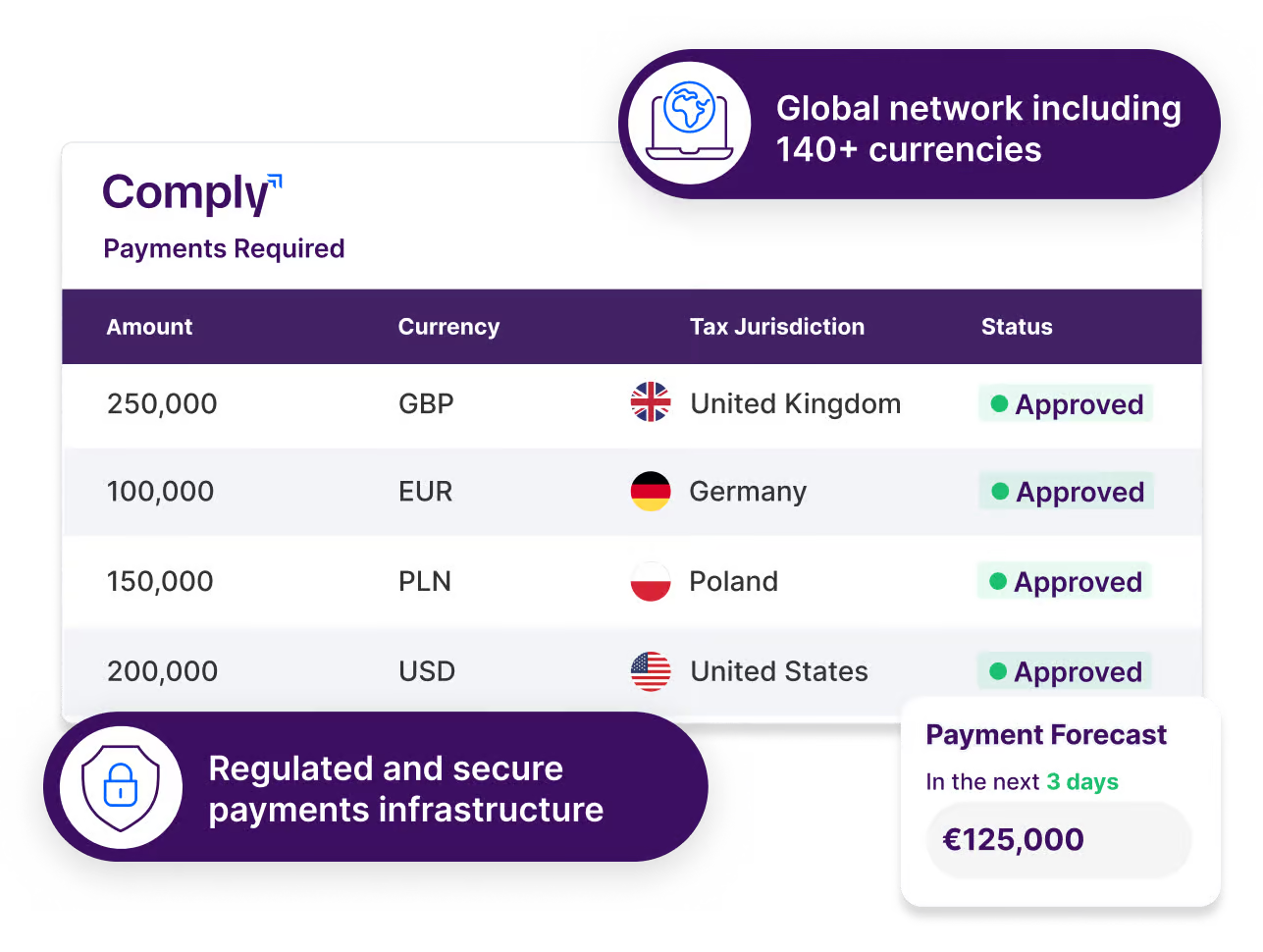

Integrated payments technology

Comply’s integrated payments enables secure, cross-border payments directly to tax authorities in local currencies. Eliminate the risk of delays, reduce administrative burden and ensure compliance every time.

Turn-key eInvoicing

integration

Support full lifecycle eInvoicing in compliance with local and EU-wide mandates. Automate the issuance, validation, exchange, and archiving of electronic invoices, integrated directly into your VAT compliance processes for complete efficiency.

Why Fintua

Fintua are reimagining what financial technology can achieve to help businesses thrive in a digital-first economy.

Risk mitigation

Avoid multi-million penalties due to non-compliance with indirect-tax regulations.

ROI

VAT reclaim funds VAT compliance for many of our customers, reducing long-term technology costs.

One global supplier

VAT compliance, eInvoicing, VAT reclaim and global payments through a singular, self-contained platform.

Efficiency

Automate processes, reduce manual effort and allocate resources more effectively.

Cutting-edge security

Your data. Protected at every level.

At Fintua, security is never an afterthought – its foundational. All data in transit is encrypted using SSL certificates (TLS 1.2), safeguarding your confidential information from unauthorised access. We partner with trusted providers like Interxion and AWS to ensure enterprise-grade protection and compliance across every jurisdiction.

Adaptable VAT compliance

solutions for every business

ROI Calculator

Unlock your potential with the Comply ROI calculator

See exactly how much time, money and value you can gain. Our ROI calculator shows the real-world impact of using Comply. Just enter a few key business metrics to discover how much you can save through automation, error reduction, and improved efficiency. It’s a fast, data-driven way to validate your investment and make confident, informed decisions.

The OLD way

Traditional and

Big 4 solutions

The New way

VAT compliance

with Fintua

| Onboarding & Implementation | Slow, manual setup; lengthy onboarding; fragmented or custom builds | Rapid onboarding, turnkey integration, ready to scale |

| Provider Model | Multiple local agents or resource-heavy centralised teams; siloed systems | One unified platform for global VAT, eInvoicing, and payments |

| Process Automation | Manual preparation, filing, and payments; partial automation reliant on spreadsheets | End-to-end automation: prepare, validate, submit, pay |

| Regulatory Coverage | Struggles to keep up with evolving global digital tax reforms and einvoicing mandates | Real-time updates inline with global tax and einvoicing reforms |

| Error Reduction | High error rates, manual reviews, increased audit and penalty risk | Automated checks, configurable rules, and full audit trail |

| Data Accuracy & Visibility | Disparate data, limited oversight, delayed or fragmented reporting | Centralised dashboards, real-time analytics, and trend analysis |

| Payments Handling | Manual, cross-border payments are slow and costly | Integrated, automated cross-border tax payments in local currencies |

| Inbuilt eInvoicing | Separate providers or add-ons needed for eInvoicing; limited integration | Flexible, turnkey eInvoicing built-in to meet global mandates |

| Audit Readiness | Poor record-keeping, fragmented documentation, hard to track submissions | Historic, tamper-proof audit trail and instant access by entity |

| Cost & Value | High admin costs, premium pricing, hidden fees, and missed deadlines | Predictable, transparent pricing; reduced total cost |

| Scalability | Difficult and costly to expand across new markets or entities | Effortlessly scales with your business globally |

| Support & Flexibility | Inconsistent support, limited agility, or high-cost dedicated teams | Tiered support, configurable managed/self-service options |

| ROI & Business Impact | Compliance is a cost center, slows growth, and stretches resources | Compliance drives efficiency, supports global growth, and enables rapid expansion |

Move away from fragmented, manual, and costly compliance. Comply’s single, automated solution with integrated eInvoicing and global payments delivers accuracy, visibility, and control while reducing risk, lowering costs, and enabling rapid global expansion.

Expand your knowledge

with the Fintua Knowledge Hub

Trusted by businesses worldwide, the Fintua Knowledge Hub is your number-one source for Indirect Tax education and inspiration.

Customer stories

12,000+ customers globally control their indirect taxes with Fintua

Frequently asked questions

-

What are the benefits of using Comply?

Comply simplifies global VAT compliance through automation, integrated payments and real time analytics. It reduces manual errors, saves time and ensures regulatory accuracy across jurisdictions. Businesses benefit from scalable solutions, enhanced audit readiness and secure data handling.

-

What support options are available with Comply?

Fintua offers flexible support models tailored to your business needs:

- Fully Managed SaaS: Fintua handles everything from preparation to submission, while you maintain full visibility via dashboards.

- Self-Service SaaS: Your team manages compliance using the Comply platform, with onboarding and ongoing support from Fintua.

- Hybrid Model: A mix of managed and self-service options, ideal for businesses expanding into new regions or managing complex tax landscapes.

-

How does Comply simplify VAT compliance for global businesses?

Comply takes the complexity out of global VAT compliance. It automates the entire process – from preparing returns to submitting them – across multiple jurisdictions. By integrating with your ERP system, it cuts out manual work, reduces errors and saves valuable time.

You also get:- Real time dashboards

- Built in eInvoicing

- Integrated payments

It’s everything you need to stay compliant, stay accurate and stay in control – all in one place

Rise Above the Rest

Maximise your potential with our full suite of connected solutions

VAT recovery solution

Recover automates the process of identifying and reclaiming VAT on business expenses, both domestically and internationally, helping you boost your bottom line.

Integrated payment solution

Pay simplifies international payments, reducing complexity and costs while ensuring compliance with local regulations and improving financial visibility.

eInvoicing solution

eInvoice enhances efficiency by digitising your einvoicing process, ensuring compliance across multiple jurisdictions and improving cash flow management.