Russia VAT guide

Russia VAT guide for businesses

In Russia, Value Added Tax (VAT) was introduced in 1992. The scope of VAT covers the supply of goods, work and services used or performed in the territory of the Russian Federation.

The Authority responsible for VAT is the Ministry of the Russian Federation for Taxes and Levies (Federal Tax Service).

Menu

What is the VAT rate in Russia?

A Standard VAT rate of 20% applies to most goods and services in Russia. A Reduced VAT Rate of 10% applies to food, children’s clothes, books, medical equipment and some services. There is also a Special VAT Rate of 16.67% applicable to e-services.

Requirement to register for VAT

There is no registration threshold above which registration would be necessary. Companies should register when there is any taxable activity. Nevertheless there is a possibility to request exemption from VAT if the company’s turnover is below RUB 2 million in the proceeding 3 years.

Generally the registration procedure should take only 5 days; however it usually takes longer.

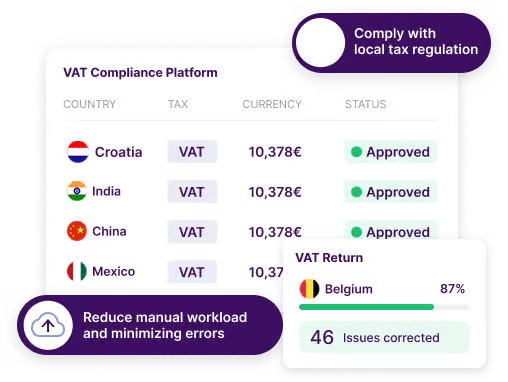

Comply – Global VAT compliance

Our VAT compliance solution, Comply helps companies manage their complex, country-specific tax requirements including Russia’s VAT obligations.

Using AI and machine learning, our technology puts your VAT data through over 300 automated VAT rules, checking for errors, and preparing VAT returns for approval and submission. Comply provides a full audit trail for the Russian Tax Authorities.

Invoicing requirements

According to article 169 of the Tax Code, the following information should be recorded on an invoice:

- The sequential number and date of issue of the invoice

- The name and address of the seller and the purchaser

- The TIN (Taxable Person Identification Number) and CRR (Code of the Reason for Registration) of both the seller and purchaser

- The name and address of the consignor and of the consignee

- The number and date of the payment and settlement document where advance or other payments are received in respect of future supplies

- A description of the goods supplied or dispatched, services rendered or works performed, or property rights transferred

- A unit of measurement (where determinable)

- The quantity of goods or the scope of services or works

- Currency of the invoice

- The price/tariff per unit of measurement under the agreement excluding VAT or state-regulated prices/tariffs

- The value of goods, services, works or property rights for the entire quantity of goods, services, works or property rights, excluding VAT

- The amount of excise tax in the case of excisable goods

- The tax rate

- The amount of VAT charged to the purchaser as determined on the basis of the applicable tax rate

- The total value of goods, services, works or property rights, including the amount of VAT

- The country of origin of the goods

Only in case the goods in question are originated from a foreign country:

- The code of the type of product in accordance with the unified Foreign Economic Activity Commodity Nomenclature of the Eurasian Economic Union. The information referred to in this sub-clause shall be indicated with respect to goods imported from outside the Russian Federation into the territory of a member state of the Eurasian Economic Union.

- The number of the customs freight declaration; and

Deadlines and filing frequency

The basic filing frequency is quarterly. Both submission and payment deadlines falls on the 25th day of the following month after the reporting period.

Submission

Submission of the VAT returns should be done electronically through the assigned tax office’s website.

Agents and fiscal representatives

It is not obligatory for any company (either local or foreign) to have a representative at the Russian Tax Authority, because in general each taxable person should be responsible for its tax matters.

Nevertheless it is possible to appoint a Tax Agent or Representative who can act on behalf of the taxable person.

Rise Above the Rest

Maximise your potential with our full suite

VAT compliance solution

Rise above complex indirect tax challenges with Comply, Fintua’s revolutionary platform for global indirect tax compliance.

VAT recovery solution

Recover automates the process of identifying and reclaiming VAT on business expenses, both domestically and internationally, helping you boost your bottom line.

Integrated payments solution

Pay simplifies international payments, reducing complexity and costs while ensuring compliance with local regulations and improving financial visibility.

eInvoicing solution

eInvoice enhances efficiency by digitising your einvoicing process, ensuring compliance across multiple jurisdictions and improving cash flow management.