The VAT gap and the need to reform

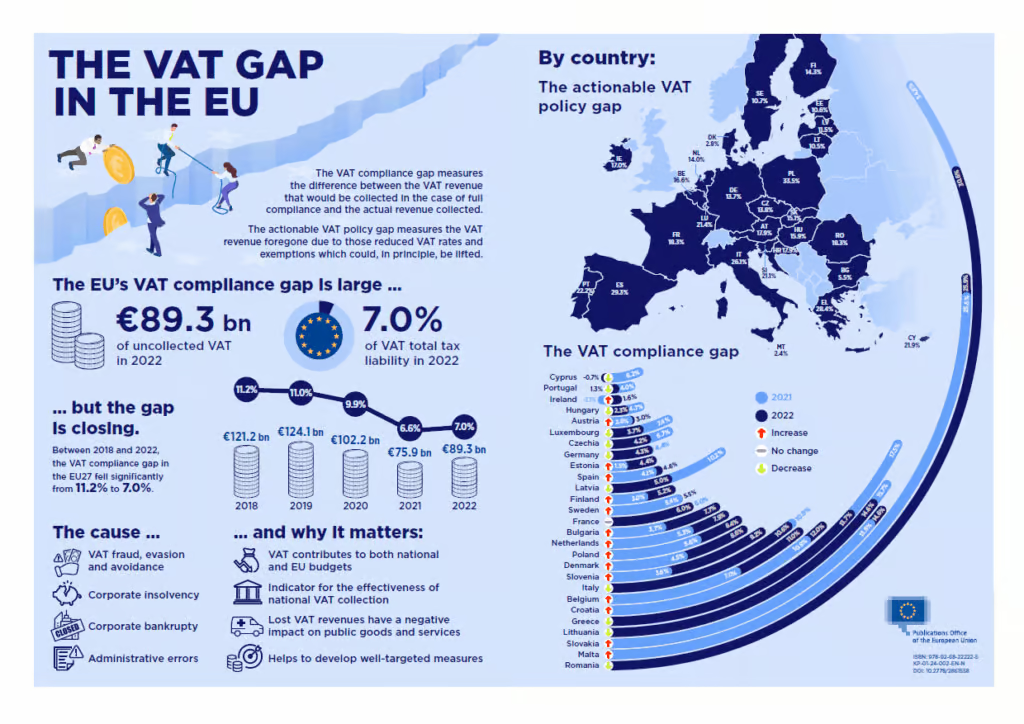

The European Commission’s VAT Gap study measures the difference between the VAT revenue expected and what is actually collected by Member States. While recent progress has been encouraging, the European Union’s VAT gap remains substantial. In 2022, Member States lost around €89 billion in VAT revenues, compared to €121 billion in 2018. This reflects the positive impact of targeted policy measures and the increasing of digitisation of tax systems across the EU.

However, the persistent gap still points to ongoing challenges such as VAT fraud, evasion, avoidance, miscalculations and administrative inefficiencies. The acceleration of cross-border trade, online commerce and the platform economy has further complicated VAT enforcement and monitoring.

To address these issues, the European Commission has proposed the VAT in the Digital Age (ViDA) initiative, a comprehensive reform designed to modernise the EU VAT framework. ViDA aims to harness real-time digital reporting and eInvoicing to create a more transparent, harmonised and efficient VAT system across the single market. By leveraging technology, the initiative seeks to close the VAT Gap, simplify compliance and strengthen Member States’ capacity to combat fraud in an increasingly digital economy.

Overview of the ViDA framework

ViDA proposals are designed to make the EU VAT system more resilient, efficient and future-ready. ViDA focuses on three core key pillars that leverage digitisation to strengthen compliance and simplify cross-border VAT processes.

1. Digital Reporting Requirements (DRR): The introduction of real-time digital reporting and mandatory eInvoicing for cross-border B2B transactions will provide tax authorities with near real-time visibility of trade flows. This will significantly enhance fraud detection, reduce reporting errors and streamline VAT administration across Member States.

2. Platform Economy: To ensure a level playing field and reduce non-compliance, online platforms facilitating the sale of goods, short-term accommodation and passenger transport services will be deemed VAT suppliers in specific circumstances. This reform reflects the growing importance of digital platforms and aims to ensure consistent VAT treatment across the single market.

3. Single VAT Registration (SVR): The expansion of the One-Stop Shop (OSS) and introduction of new mechanisms such as Transfer of Own Goods (TOOG) scheme will allow businesses to register once for VAT purposes across the EU, easing administrative burdens for cross-border traders.

According to the European Commission, the ViDA package could deliver net economic benefits of between €172 billion and €214 billion over 10 years, including €51 billion in savings for businesses through simplified VAT processes and reduced compliance obligations.

ViDA implementation objectives

The success of ViDA depends on coordinated action across Member States, businesses and EU institutions. To deliver on its promise of a harmonised and future-ready VAT system, ViDA’s implementation is guided by key objectives:

- Establish a harmonised EU-wide framework for the implementing ViDA measures, ensuring that timings, reporting requirements and system interfaces are consistent across Member States.

- Minimise regulatory and technological fragmentation so that businesses operating in multiple jurisdictions are not faced with divergent rules, formats or IT infrastructures.

- Ensure IT readiness and capacity building for both tax authorities and businesses, so that they are prepared for the transformation and have the required technical infrastructure and skills in place to support it.

To achieve these goals, the European Commission has proposed a phased implementation plan running from 2025 to 2035, allowing Member States and businesses to adapt gradually to new requirements. This process will combine legislative actions, IT system development and capacity-building initiatives to ensure a smooth and coordinated transition across the EU.

ViDA phasing and timeline

| Milestone | Action/Focus | Responsible |

| Mar-Apr 2025 | ViDA package adopted and enters into force; Member States may introduce eInvoicing | Commission /Member States |

| 2026 | Adoption of Implementing Regulations (central VIES, digital reporting requirements, secure IOSS); technical specifications finalised | Commission / Fiscalis Project Groups |

| Jan 2027 | OSS/IOSS updates and first single VAT registration (SVR) clarifications apply | Commission /Member States |

| Jul 2028 | Platform economy measures (deemed supplier); SVR core reforms and mandatory reverse charge | Member States / Businesses |

| Jul 2030 | Cross-border digital reporting requirements (eInvoicing mandatory) | Commission / Member States |

| Jan 2035 | Domestic systems aligned with EU cross-border digital-reporting requirements | Member Stattes |

Governance and coordination

Effective governance will be critical to the success of ViDA, ensuring that implementation is consistent, transparent and collaborative across the European Union. The strategy depends on robust coordination mechanisms and open communication between EU institutions, national tax authorities and businesses.

1. Commission engagement mechanisms

Technical coordination is supported by several existing bodies, including the VAT committee, the Group on the Future of VAT (GFV), the Standing Committee on Administrative Cooperation (SCAC), the Standing Committee on Information Technology (SCIT). Together, these groups facilitate alignment on legal, operational and IT aspects of the initiative.

In addition, the Fiscalis Project Groups (FPGs) play a key role in developing common IT specifications, sharing best practices and providing peer-to-peer support among Member States.

2. Political oversight

The European Commission will ensure regular progress reporting to the European Parliament and the Council, promoting visibility, accountability and continued political commitment throughout ViDA’s phased rollout.

3. Business outreach

Engaging with the private sector is a cornerstone of ViDA’s governance model. Ongoing engagement via VAT Expert Group (VEG) and Fiscalis workshops enables businesses of all sizes to contribute feedback, raise implementation challenges and stay informed on their upcoming obligations.

Together, these governance structures aim to foster collaborative, transparent and well-coordinated approach to implementing ViDA across the EU.

Core components of the ViDA implementation strategy

The ViDA implementation strategy is built around three complementary tracks – legislative, technical (IT development), and capacity building and communication. Together, these form the foundation for a harmonised, phased rollout across all Member States.

Legislative track

The successful adoption of ViDA will require a robust legal framework. At least six Implementing Acts will be introduced to define the detailed rules for:

- Digital reporting requirements (DRR) under Article 263(4).

- The central VIES (VAT Information Exchange System) architecture

- A secure Import One Stop Shop (IOSS) model

Deadlines are expected to span from 2025 to 2030, providing Member States with a clear timeline for implementation. Compliance will be monitored through the Themis database, with infringement procedures applied in cases of delay or non-compliance.

IT development track :

The technical rollout will underpin ViDA’s digital infrastructure. A new central VIES system will be developed and deployed between 2025 and 2029, with all national systems required to interface by July 2030.

The Single VAT Registration (SVR) component will follow a two-stage rollout, beginning with the OSS v7.7 release and followed by the main Transfer of Own Goods (TOOG) module, ensuring gradual adaptation by national authorities and businesses.

Capacity building and communication:

To support effective adoption, the European Commission will implement a comprehensive communication and capacity-building plan in coordination with Member States.

- Outreach campaigns will be launched 6–9 months before key milestones to allow businesses adequate preparation time.

- Regular updates will be shared through the “Europe ViDA” information page and the OSS portal, ensuring that all stakeholders remain informed and engaged throughout the process.

Risk management framework

| Risk area | Impact | Mitigation measure |

| Member States not ready with IT by 2030 | Medium | Step-by-step plan, monitoring of national and central VIES progress |

| “Gold-plating” (Extra national requirements) | Low | Clear EU standard, legal resources for divergence |

| Different software ceritificaion rules | Medium | Mutual recognition encourage, explanatory guidance |

| Platform obligations inconsistent across Member States | Likely | Commission explanatory notes and harmonised options |

| SVR delays/ incomplete TOOG module | Medium | Commission back-up solutions and close collaboration |

| Low SME readiness | Low | Broad communication and training campaigns |

Support tools for implementation

The European Commission has established a range of support tools to assist Member States and businesses in implementing ViDA effectively.

- Explanatory notes: Technical guidance on eInvoicing, deemed supplier rules, TOOG and reverse charge mechanisms, helping ensure consistent interpretation and application.

- Fiscalis actions: Workshops, peer learning and best practice sharing to strengthen capacity and coordination among Member States.

- Technical Support Instrument (TSI): Funding to help national administrations develop and maintain the necessary the digital infrastructure.

- Enforcement and monitoring: Ongoing monitoring through the Themis database, with automatic infringement procedures triggered by unjustified IT delays.

Stakeholder feedback: Implementation dialogue

Early implementation discussions with businesses and tax authorities have highlighted several important insights:

- Risk of fragmentation: Businesses emphasise the need for harmonised guidance and consistent interpretation across jurisdictions to avoid confusion and inefficiencies.

- SME support is critical: Smaller businesses require adequate lead times of 18 months or more ahead of national rollouts to plan and allocate resources effectively.

- Clarity drives compliance: Access to up-to-date information on ViDA obligations is essential to enable timely and accurate compliance.

- Inclusivity matters: There is growing consensus emerging that ViDA must be viable for all business sizes – from large multi-jurisdictional groups to micro-enterprises, to ensure the reform achieves its objectives across the EU.

Final Thoughts

The ViDA initiative represents one of the most significant VAT reforms in decades, marking a decisive move towards a fully digital and harmonised VAT landscape across Europe. For businesses, the message is clear: now is the time to prepare.

Now is the time to:

- Identify internal gaps in VAT reporting and compliance processes.

- Align IT strategies with upcoming digital reporting and eInvoicing requirements.

- Engage with experts to understand and implement ViDA obligations effectively.

- Empower indirect tax teams with the tools and knowledge needed to navigate the transition.#

For VAT and compliance professionals, Fintua provides guidance, automation tools and expert support to help businesses streamline compliance, reduce risk and fully leverage the opportunities presented by ViDA.

Subscribe to our newsletter

Stay informed about the latest VAT news, trends and topics from around the globe with our monthly newsletter. Each month, we deliver insightful updates straight to your inbox, helping you stay ahead of the curve.